BRISCON - Transaction Advisory

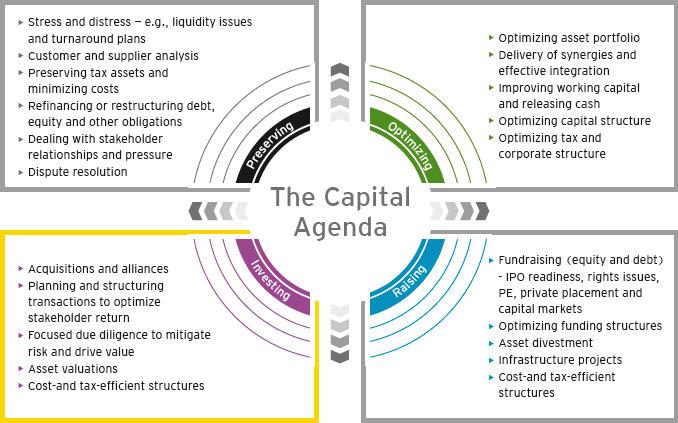

Briscon extend transaction advisory services to its existing clients on ongoing infra projects to raise funds either by debt or equity, project finance, IPOs, Joint Ventures or merger & acquisitions.

Our approach is designed to identify key issues and opportunities to review the proposed scenarios, pre assessment and due diligence with respect to the proposed project.

Project and structured finance

Obtaining finance which prices risk correctly is key to enhancing shareholder/investor value. Briscon can offer a palette of services to overcome this challenge.

|

Your Objectives |

What we can do: |

|

Early identification of key issues |

Carry out an initial assessment of: The viability of a proposed project to identify the key opportunities and risks; The suitability of an acquisition for structured finance. |

|

|

Undertake focused due diligence to gather the appropriate information to support the key assumptions underpinning the evaluation of the project/business. |

|

|

Undertake research into industry trends and customer intentions to allow an informed evaluation of sensitivities. |

|

|

Prepare or review financial models to properly evaluate the economic drivers of the transaction. |

|

|

|

|

Reducing the weighted average cost of capital post-acquisition |

Assist you to allocate liabilities and contingent liabilities to optimise valuation in quantifying liabilities, assessing ownership, advising on the basis of allocating pension fund obligations, assessing working capital requirements and sensitivities. |

|

|

Advise on the financial and risk allocation aspects of the contractual arrangements. Advise on the appropriateness of financial covenants in the loan/bond documentation by running appropriate sensitivities within the model and ensuring these are properly documented in the contracts |

|

|

Advise on effective internal procedures to control business risks by benchmarking proposed procedures against best practice and providing guidance on the appropriate systems to optimise investor/lender reporting |

|

|

Help you to minimise tax leakage and maximise distributable reserves by identifying tax efficient structures |