BRISCON Group - Project Finance Services

Briscon Group have decade of experience in arranging finance debt or equity from capital markets, banks, financial institutions, NBFCs and other market entities through various offering of financial offerings.

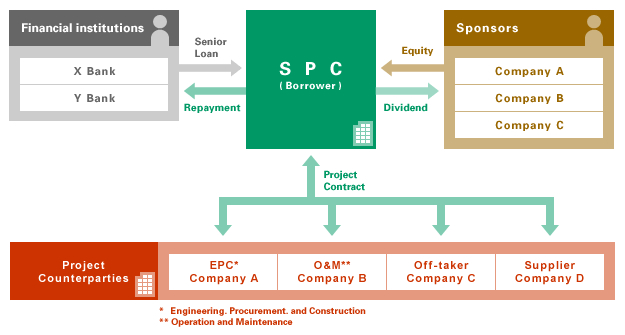

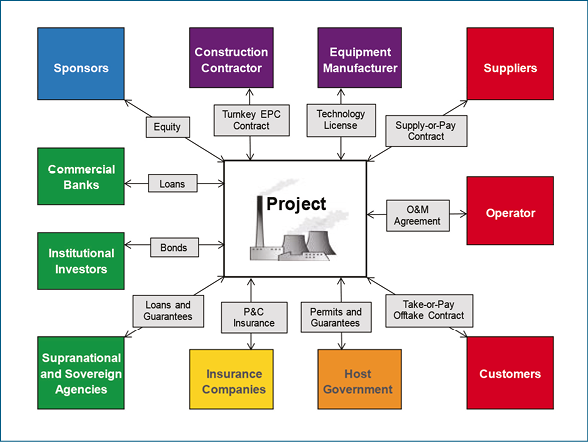

We extend this services to our existing clients in supplement to project management services for arranging infrastructure finance for ongoing project. The fund / non fund exposure is generally is 75% of the project cost, secured by project assets and repaid entirely from project cash flows. We evaluate requirements of other securities and collaterals like guarantees, immovable assets, etc. Repayment is usually monthly, quarterly or structured with a flexible tenure based on project cash flow.

Fund Based Credit Limits

Term Loan

We extend corporate finance to infrastructure borrowers based on cash flows of existing business, and financial strengths like balance sheet, etc. to meet normal capital expenditure. The tenure is usually up to 5 years, with repayment in monthly or quarterly installments.

Structured Finance

We provide structured credit solutions in line with specific requirements of our customers. Our structured finance transactions are mostly a hybrid of bridge finance and term loan, and could have characteristics of term loan but usually with maturity not exceeding 5 years. Repayment and security terms are also structured in a manner that mitigates risk and provides flexibility for meeting the unique needs of our customers.

Non Fund Based Credit Limits

The Project Finance division extends non-fund based financial assistance to customers by leveraging credit line from bankers through Letter of Credit (LC) and Bank Guarantee (BG) facilities. LC and BG facilities are extended to customers with the appropriate cash margin.